The Importance of Driving Proactive Profitable Growth

With budgeting season on the horizon for many organisations, there is no denying the economic headwinds. From soaring interest rates to declining demand, many businesses are struggling to maintain their growth trajectories. Complicating matters is the fact that for boards and investors, top-line growth is only part of the picture. Against this monetary background profitability matters.

In any environment where investment capital is no longer free, it is important that a business' operations can fuel themselves, to avoid being hampered by increasing interest payments. For this reason, it is not surprising that many of the conversations at the moment are about budget cuts or staff layoffs.

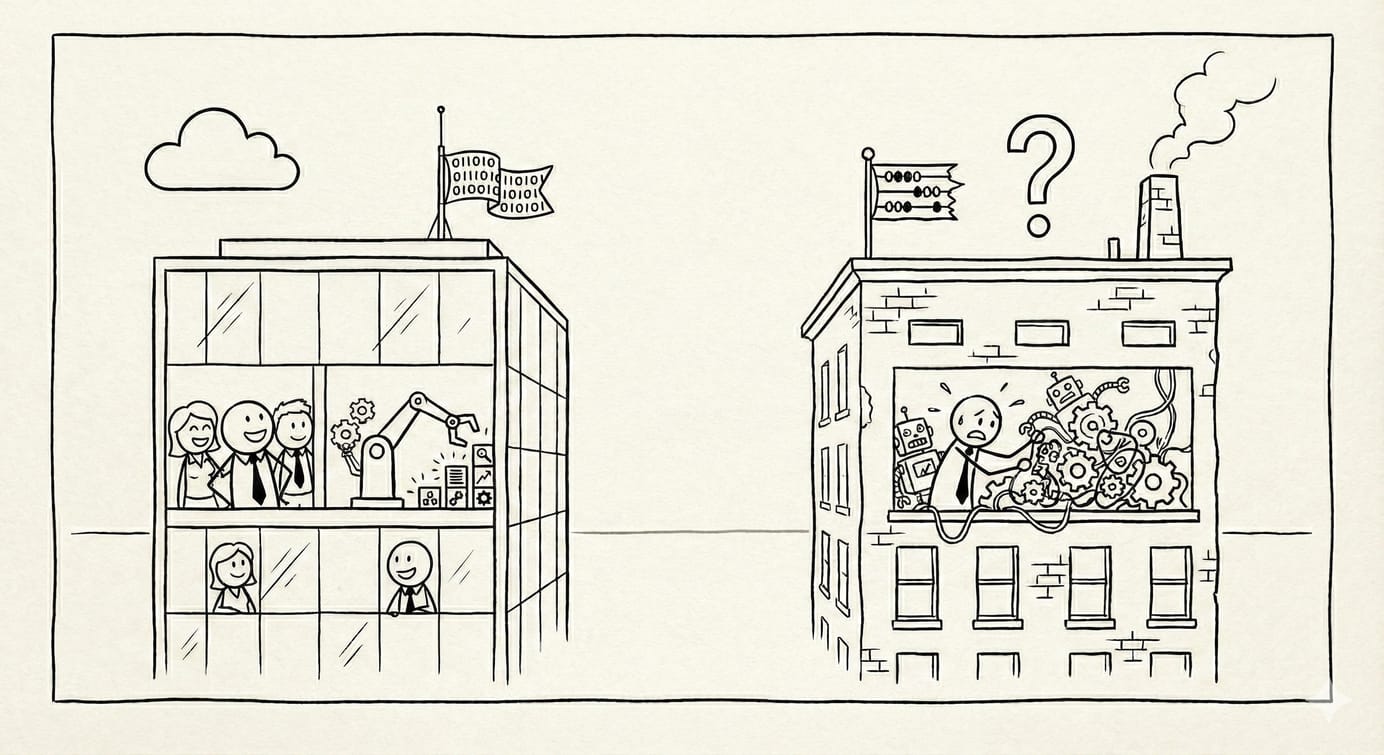

Are cuts always the best answer? Where they trim non-performing resources or right-size capacity that will demonstrably not be required in the near term, they can make a lot of sense. Yet, when they undermine the organisation's operational efficiency through loss of expertise or capability, they can do a lot of harm. In such cases, businesses would be better served by seeking to transform rather than scale back their operations.

Given the difficulty in increasing profit margins on products and services without the use of subtle price hikes or tricks like shrinkflation, let us consider three areas of major investment where operational efficiency can be increased.

Firstly, while marketing budgets often make tempting targets for cuts, it is important to distinguish between traditional and digital channels. The latter allow for a much greater degree of measurement and targeting and used correctly can greatly increase media efficiency. For instance, artificial intelligence can assist in identifying key attributes of a company's most valuable customers, allowing for targeted advertising across platforms like Google, Snap, and Instagram.

Another area worthy of consideration are repetitive labour intensive tasks, such as processes that involve searching, summarising, or comparing large volumes of documents. Thanks to recent breakthroughs in generative AI, these processes can now be largely automated, with human labour moving up the value chain to focus on validation and editing. Instead of cutting customer care or paralegal headcount, why not empower them with the right tools?

Finally, if one casts a critical eye on how strategic ambition relates to practical reality, it is easy to find major unlocks. For example, how many business purport to be customer-centric, yet do not even have a single view of their customer? Similarly, how many manufacturers are blindsided by supply chain challenges that could have been resolved with a more granular, timely, or connected view of their business? Solutions to these problems are readily available.

These three examples illustrate that for businesses of a certain size, the required investments – usually less than $5M – will easily pay for themselves within the first year of operation. In other words, if you want to drive profitable growth, there is a real opportunity to do so through smart investment, and not haphazard cost cutting fueled by fear or uninspired management.

Organisations can learn valuable lessons from the 1980s TV show Hill Street Blues which spawned the catch-phrase "Let's do it to them, before they do it to us!" Businesses who fail to seize the initiative and transform themselves will face increasing pressure to reduce costs through brute force measures like blanket budget cuts and headcount freezes. Those that channel some of that Hill Street attitude will have a significant competitive advantage in the years to come.

– Ryan

Cover photo by Andrej Lišakov.

Q* - Qstar.ai Newsletter

Join the newsletter to receive the latest updates in your inbox.